Texas House Proposes School Property Tax Cuts—What This Means for Homeowners in Conroe and Surrounding Areas

Big news for Texas homeowners! The Texas House is pushing forward with a proposal to reduce school property tax rates, which could bring relief to homeowners in Conroe, The Woodlands, Spring, Tomball, Magnolia, Montgomery, Willis, and New Caney. House Bill 8 (HB 8), if passed, would cut school district tax rates by about $0.10 per $100 of taxable property value, a move that could make homeownership more affordable in our area.

But what does this mean for you as a homeowner, buyer, or seller in Montgomery County and beyond? Let’s break it down.

How Much Could Homeowners Save?

School district property taxes make up a significant portion of a homeowner’s annual tax bill. Under HB 8, the proposed tax compression would reduce these taxes by approximately $0.10 per $100 of taxable property value.

For example, if you own a home in The Woodlands valued at $400,000, this cut would translate to $400 in annual savings. For a $600,000 home in Conroe, the savings would be $600 per year. While this may not seem like a dramatic reduction, it can add up over time and contribute to overall housing affordability.

Will This Make Homeownership More Affordable?

Lower property taxes could ease the financial burden on homeowners, but the extent of relief depends on local tax policies and other market factors. While HB 8 aims to provide tax cuts, some experts warn that these savings could be offset by increasing property values and local tax rate adjustments.

However, if the bill passes, here’s what we could expect:

✅ Lower annual property tax bills, making homeownership slightly more affordable.

✅ A potential increase in home values, as lower taxes make homeownership more attractive.

✅ Possible relief for renters, as landlords may pass on some savings to tenants.

Impact on the Local Housing Market

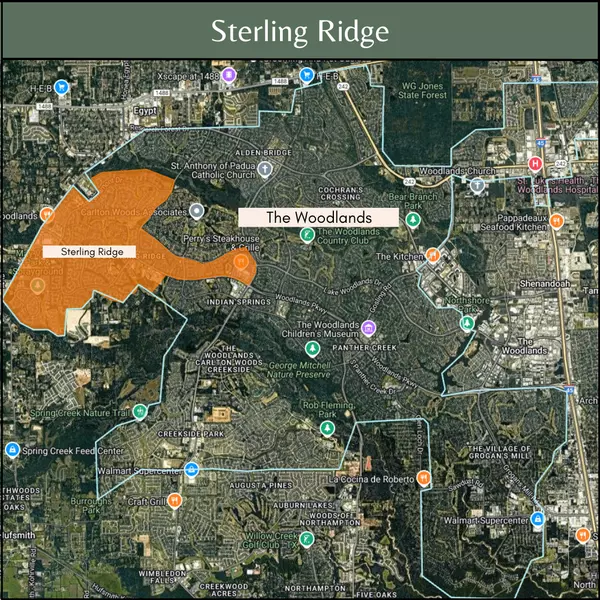

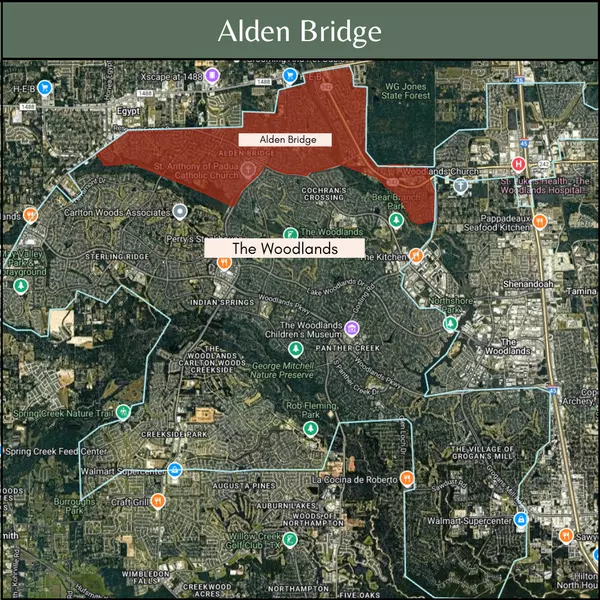

The Conroe, The Woodlands, and Montgomery County real estate markets have been growing rapidly, with home prices on the rise. Tax cuts could fuel further demand, especially for first-time buyers looking for affordability.

If property tax rates decrease:

- Buyers may have more purchasing power, making it easier to qualify for a mortgage.

- Homeowners may see increased home values, as lower taxes make properties more attractive.

- Investors and landlords could benefit, potentially leading to more rental availability.

However, there is also concern that past tax cuts have been eroded by rising home appraisals and other tax increases at the local level. If local taxing entities adjust their rates or if property values continue to climb, the full benefit of this tax relief could be limited.

Potential Challenges & Considerations

While the proposed tax cut seems beneficial, some experts caution that relying on Texas’ current budget surplus to fund these reductions may not be sustainable long-term. If the state’s revenue declines, school districts could face funding challenges, which might lead to future tax rate increases or reduced educational services.

Additionally, critics argue that without tighter restrictions on local tax rate adjustments, the benefits of tax relief could be short-lived.

What’s Next?

HB 8 is currently pending in the Texas House Ways and Means Committee. If approved, the tax cuts would take effect in the next budget cycle. Additionally, a separate proposal (HB 9) aims to provide tax relief for businesses, which could impact local job markets and commercial property owners.

For homeowners in Conroe, The Woodlands, and surrounding areas, it’s important to stay informed and consider how these changes might affect your long-term housing costs. If you’re thinking about buying or selling, now could be a great time to consult with a real estate professional to understand how these potential tax cuts fit into your homeownership goals.

Click here to learn more: Community Impact - Austin

Stay Informed & Make Smart Real Estate Decisions

The real estate market in Montgomery County, The Woodlands, and surrounding areas is dynamic, and tax policies can have a major impact on affordability. If you have questions about how this legislation could affect your property or your home-buying plans, reach out to a local real estate expert.

Want to stay updated on the latest real estate news in Conroe and beyond? Subscribe to our blog for market insights, home-buying tips, and local real estate trends!

📞 Need expert advice? Contact us today!

Categories

Recent Posts